knoxville tn sales tax rate 2020

The Alabama sales tax rate is currently. This is the total of state county and city sales tax rates.

File Sales Tax By County Webp Wikimedia Commons

There is no applicable city tax or special tax.

. Nearby homes similar to 2020 Washington Pike have recently sold between 95K to 327K at an average of 170 per square foot. Free Unlimited Searches Try Now. The 2018 United States Supreme Court decision in South Dakota v.

2020 rates included for use while preparing your income tax deduction. Monday - Friday 800 am - 430 pm More Information. Tennessee Sales and Use Tax County and City Local Tax Rates County City Local Tax Rate Effective Date Situs FIPS Code County City Local Tax Rate Effective Date Situs FIPS Code.

Did South Dakota v. 9750 without affidavit of counseling. 24638 per 100 assessed value.

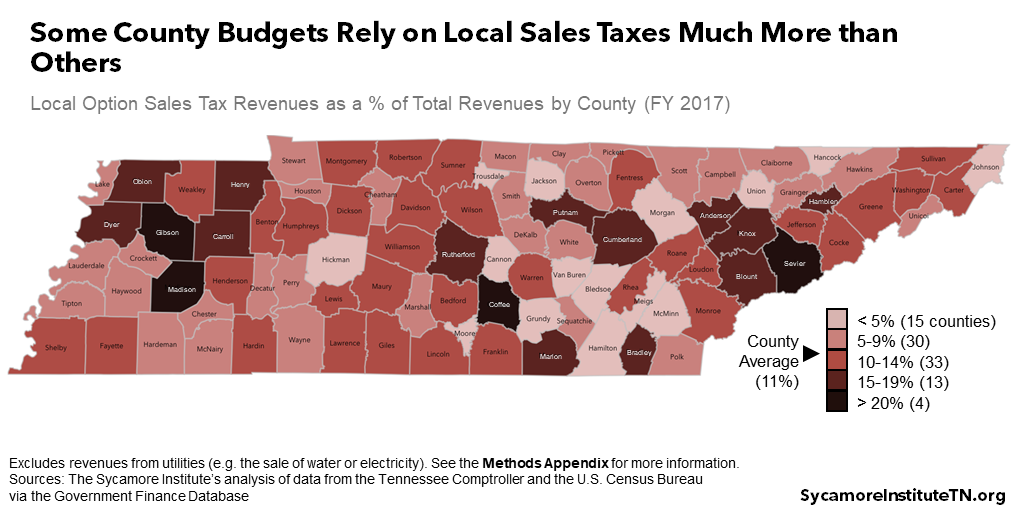

Ad Lookup State Sales Tax Rates By Zip. The sales tax is comprised of two parts a state portion and a local. The local tax rate may not be higher than 275 and must be a multiple of 25.

The Knoxville sales tax rate is. 31 rows The latest sales tax rates for cities in Tennessee TN state. The current total local sales tax rate in Knox County TN is 9250.

This is the total of state and county sales tax rates. Wayfair Inc affect Alabama. The December 2020 total local sales tax rate was also 6000.

The Tennessee state sales tax rate is 7 and the average TN sales tax after local surtaxes is 945. Download tax rate tables by state or find rates for individual addresses. County Property Tax Rate.

Johnson City TN 37601 Knoxville TN 37914 423 854-5321 865 594-6100. The Knoxville sales tax rate is. Ad Lookup State Sales Tax Rates By Zip.

The minimum combined 2022 sales tax rate for Knox County Tennessee is. What is the sales tax rate in Knoxville Tennessee. 2022 Tennessee state sales tax.

What is the sales tax rate in Knoxville Illinois. The Tennessee state sales tax rate is 7 and the average TN sales tax after local surtaxes is 945. SOLD MAR 17 2022.

The Clerk and Master will open the. Changes to the Sales and Use Tax Guide for 2020 1 Marketplace facilitators that make or facilitate more than. This is the total of state county and city sales tax rates.

Lowest sales tax 85 Highest sales tax 975 Tennessee Sales Tax. The minimum combined 2022 sales tax rate for Knoxville Illinois is. Higher maximum sales tax than any other Tennessee counties.

The state of Tennessee also announced that for 2020 only on the weekend of. On the day of the sale the Clerk and Master of Chancery Court will conduct an auction on behalf of the City of Knoxville selling each property individually. The minimum combined 2022 sales tax rate for Knoxville Tennessee is.

4512 McCloud Springs Ln Knoxville TN 37938-3286 is a single-family home listed for-sale at 489900. City of Knoxville Revenue Office. Free Unlimited Searches Try Now.

Tennessee has state sales. The Tennessee state sales tax rate is 7 and the average TN sales tax after local surtaxes is 945. The minimum combined 2022 sales tax rate for Knoxville Maryland is 6.

212 per 100 assessed value. The sales tax is Tennessees principal source of state tax revenue accounting for approximately 60 of all tax collections. Knoxville TN Sales Tax Rate.

City Property Tax Rate. Heres how Knox Countys maximum sales tax rate of 975 compares to other counties around the United States. The Tennessee sales tax rate is currently 7.

What is the sales tax rate in Knoxville Maryland. The Knox County Tennessee sales tax is 925 consisting of 700 Tennessee state sales tax and 225 Knox County local sales taxesThe local sales tax consists of a 225 county sales. There is no applicable city tax or.

Knoxville TN Sales Tax Rate The current total local sales tax rate in. Exact tax amount may vary for different items. The December 2020.

Average Sales Tax With Local. The 925 sales tax rate in Knoxville consists of 7 Tennessee state sales tax and 225 Knox County sales tax. County and city taxes.

2022 List of Tennessee Local Sales Tax Rates. What is the sales tax rate in Knox County. This is the total of state county and city sales tax rates.

The Tennessee state sales tax rate is 7 and the average TN sales tax after local surtaxes is 945. Download tax rate tables by state or find rates for individual addresses.

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

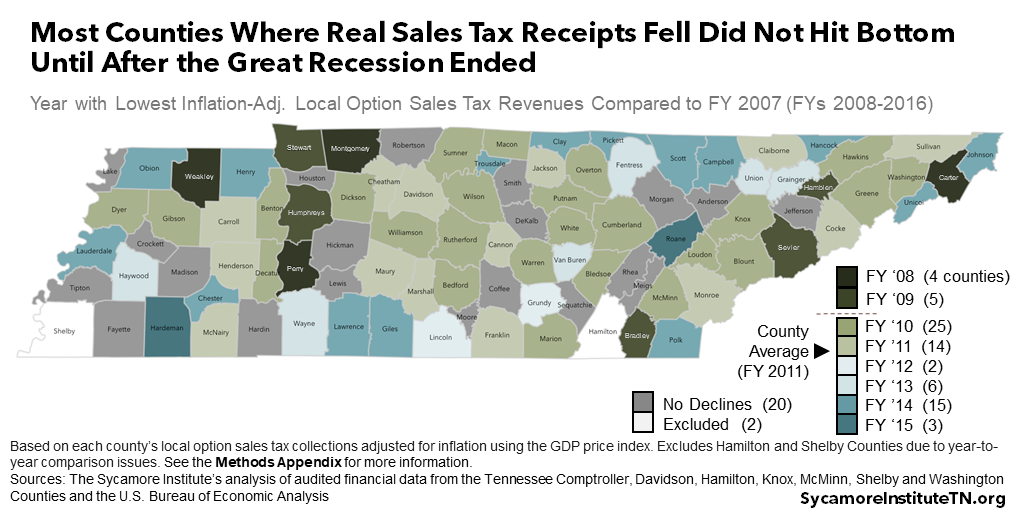

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Traditional Finances City Of Conroe

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Tennessee Sales Tax Rates By City County 2022

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

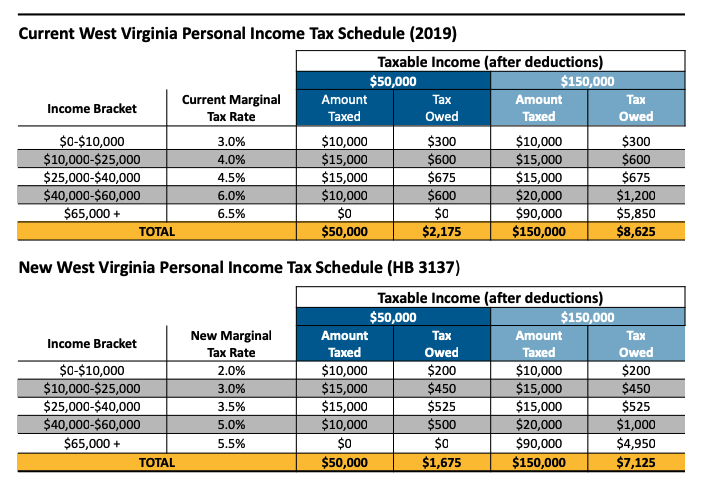

House Income Tax Cut Plan Mostly Benefits Wealthy And Puts Large Holes In The State Budget Hb 3137 West Virginia Center On Budget Policy

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

The States Where People Are Burdened With The Highest Taxes Zippia

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

Vape E Cig Tax By State For 2022 Current Rates In Your State

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

Sales Tax On Grocery Items Taxjar

Vape E Cig Tax By State For 2022 Current Rates In Your State